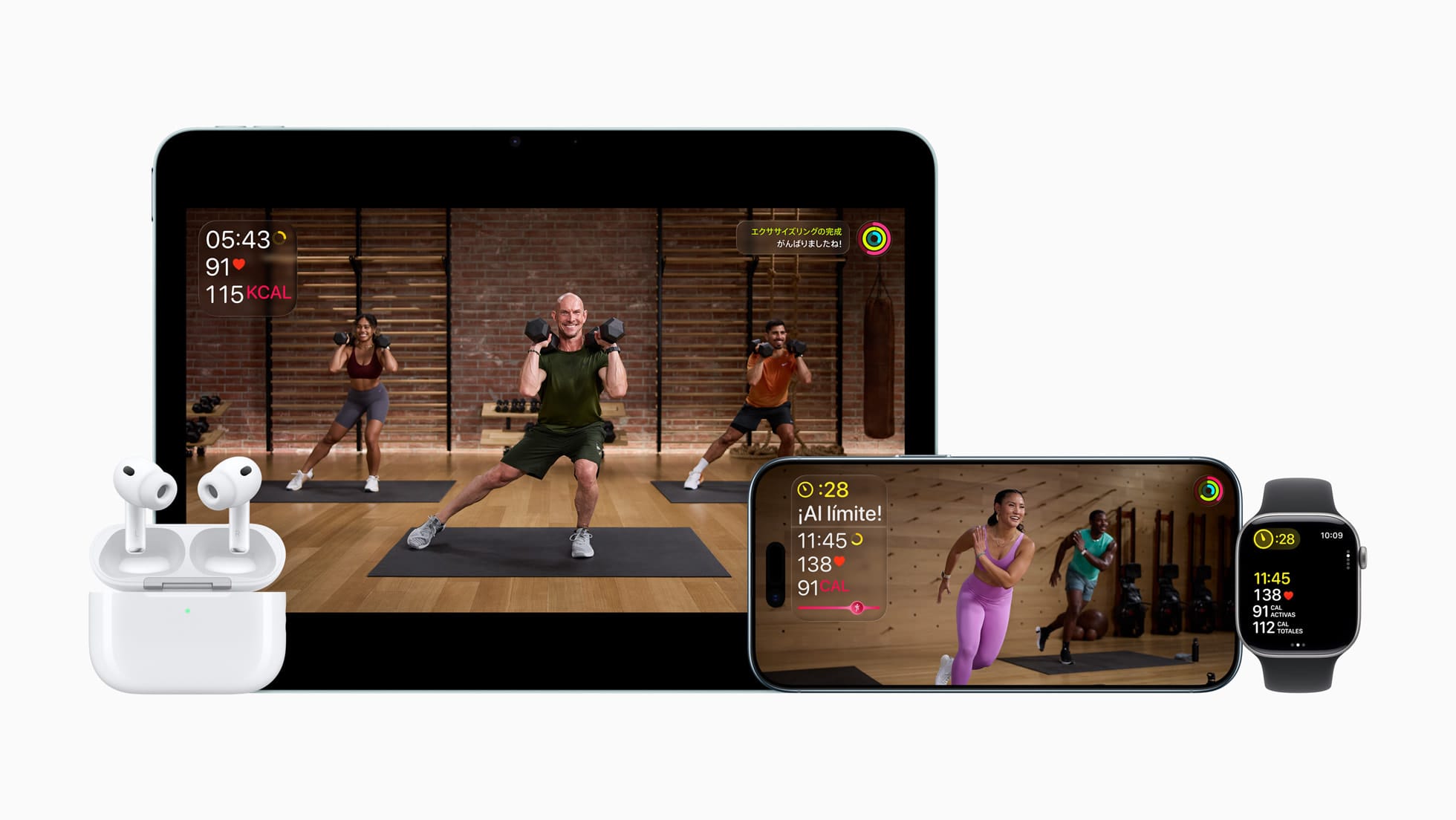

When Mark Gurman reported last month that Apple Fitness+ was "under review" following a leadership reorganization, the digital fitness service's future looked uncertain. Described as one of Apple's "weakest digital offerings" plagued by high churn and minimal revenue growth, Fitness+ seemed poised for either a major overhaul or quiet sunset.

Today's announcement of a massive 28-market expansion tells a decidedly different story—or at least, it reveals Apple's chosen strategy for addressing those challenges.

The Expansion Details

Apple Fitness+ will launch in 28 new countries and regions on December 15, with Japan following in early 2026. This brings total availability to 49 markets—the service's largest geographic expansion since its 2020 debut. The rollout targets key growth markets including India, Hong Kong, Singapore, Taiwan, Chile, the Netherlands, Norway, Poland, and the Philippines.

But Apple isn't simply flipping a switch and calling it international. The company is deploying AI-powered voice dubbing technology to localize hundreds of workouts and meditations in Spanish, German, and Japanese. Rather than hiring voice actors or re-recording content, Apple is using generated voices based on its 28 trainers' actual voices—a practical application of AI that extends content reach without exponentially increasing production costs.

The service is also adding K-Pop as a music genre across all workout types, a strategic move for markets where K-Pop dominates popular culture, particularly South Korea, Japan, and Southeast Asia.

Reading Between the Leadership Lines

The timing of this announcement is striking. Just four weeks ago, Bloomberg reported that Fitness+ had been moved under health VP Sumbul Desai's leadership, with the entire health division now reporting directly to services chief Eddy Cue. This wasn't a lateral move—it was a warning shot. Apple was effectively telling the Fitness+ team: prove your value or face consequences.

The reorganization followed broader executive transitions, including COO Jeff Williams' impending retirement and shifts in watchOS and Apple Watch hardware oversight. For a service that launched as an Apple Watch value-add, these structural changes raised existential questions about Fitness+'s role in Apple's ecosystem.

Today's expansion provides the answer: Apple is doubling down, but with a services-focused lens rather than a hardware-centric one. By moving Fitness+ under Cue's services umbrella, Apple is signaling that the platform must stand on its own revenue merits, not just serve as an Apple Watch differentiator.

The Math Problem Apple Needs to Solve

Fitness+ faces a fundamental economics challenge. At $9.99 per month, it's priced competitively—actually cheaper than Peloton Digital ($12.99) and on par with many fitness streaming services. But pricing isn't the problem; retention is.

High churn indicates users aren't finding lasting value. They might subscribe to try it, appreciate the Apple Watch integration and polished production quality, but ultimately don't stick around. The service reportedly generates minimal revenue despite being inexpensive to operate, suggesting subscriber numbers haven't reached the scale Apple needs.

Geographic expansion addresses this in two ways:

First, it's a numbers game. More markets mean more potential subscribers. If Apple can convert even a small percentage of Apple Watch owners in India—where smartphone adoption is exploding—into Fitness+ subscribers, the math starts working better.

Second, it positions Fitness+ for bundling opportunities. Apple One makes more sense in markets where multiple Apple services have strong local appeal. Adding Fitness+ availability in 28 new markets makes Apple One a more compelling package globally.

The AI Angle Deserves Scrutiny

Apple's use of AI voice dubbing is notable for what it reveals about the company's approach to both AI deployment and content scaling. This isn't generative AI creating workout instructions or AI avatars replacing human trainers. It's AI as infrastructure—taking existing, human-created content and making it accessible across language barriers.

This implementation is pragmatic and defensible. Recording hundreds of hours of fitness content in multiple languages with human voice actors would be prohibitively expensive and slow. AI dubbing based on each trainer's actual voice preserves authenticity while enabling rapid localization. It requires iOS 26.1, iPadOS 26.1, and tvOS 26.1, suggesting Apple built this capability deep into its operating systems.

However, it also raises questions about long-term content strategy. If AI can effectively localize content, what does that mean for building local trainer talent or creating region-specific programming? Will we see the same English-language workouts dubbed globally, or will Apple invest in local content creation?

What This Means for the Service's Future

Despite the optimistic expansion announcement, the underlying challenges remain. Adding markets doesn't solve retention issues unless the content itself becomes stickier. Apple needs users to form habits around Fitness+, to see it as indispensable rather than occasionally useful.

The service has advantages: seamless Apple Watch integration, high production values, no ads, and family sharing. But it also faces fierce competition from Peloton, Beachbody, Nike Training Club (which is free), and countless YouTube fitness creators who offer comparable content at no cost.

The real test will be whether this expansion generates meaningful subscriber growth and, more critically, reduces churn. If users in these new markets exhibit the same sign-up-then-cancel patterns as existing markets, geographic reach won't matter.

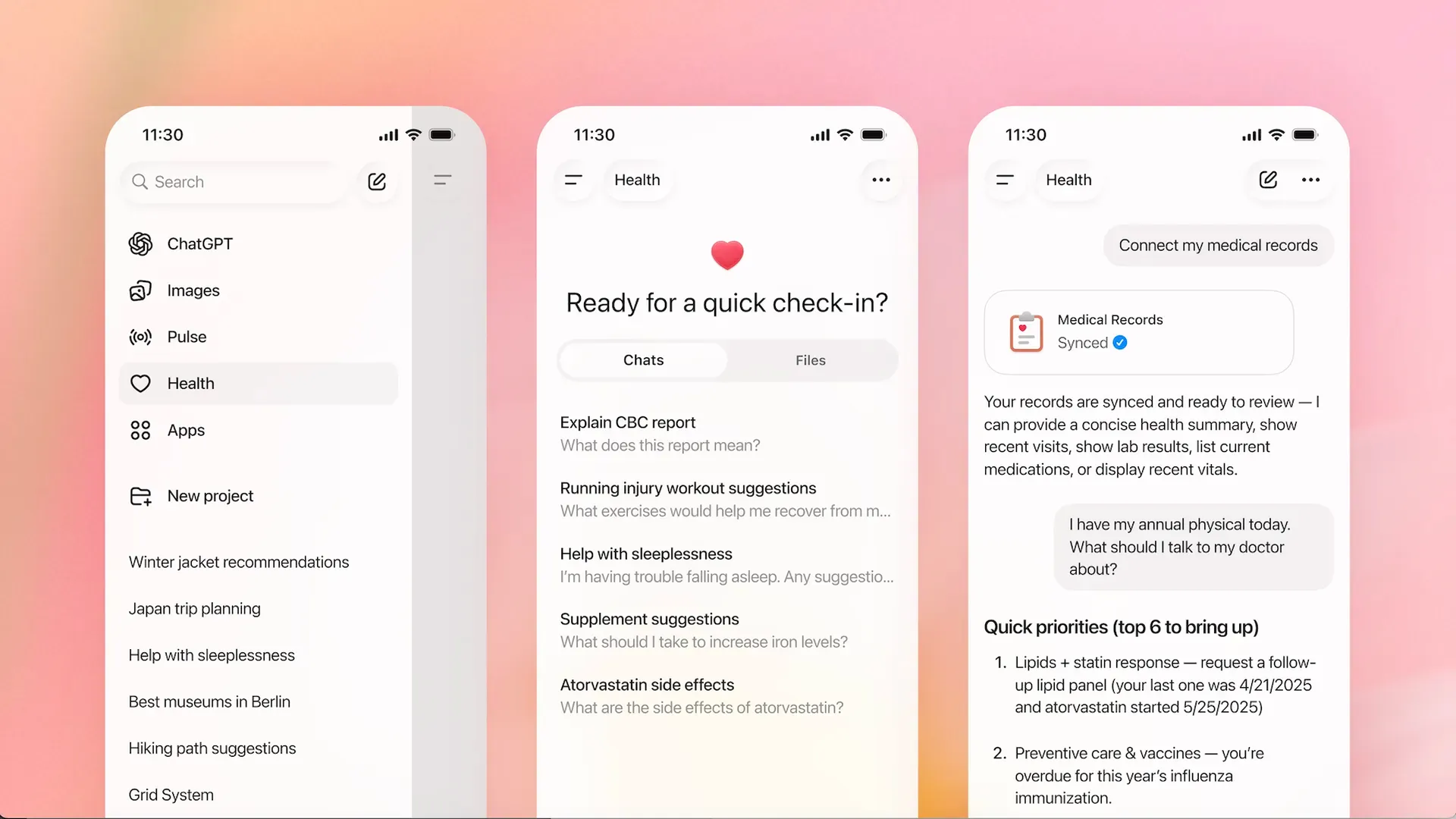

There's also the rumored Health+ service to consider. Multiple reports suggest Apple is developing an AI-powered health coaching platform expected to launch in 2026. If that materializes, Fitness+ could be absorbed into a larger health subscription tier—or potentially sidelined if Health+ captures the market attention Apple is seeking.

The Enterprise Perspective

From an IT management standpoint, this expansion creates interesting opportunities for corporate wellness programs, particularly in markets where Apple device adoption is growing among enterprise users. Organizations looking to support employee health initiatives could bundle Fitness+ subscriptions more easily, especially with family sharing allowing coverage for employees' households.

However, Apple hasn't positioned Fitness+ aggressively in the corporate wellness space the way competitors like Peloton or Whoop have. There's no enterprise admin panel, no bulk licensing structure, no integration with corporate health insurance programs. If Apple is serious about growing revenue, that B2B channel represents untapped potential.

Bottom Line

Apple's Fitness+ expansion is both a vote of confidence and a pressure test. The company is investing in scale—new markets, AI-powered localization, broader content appeal—while simultaneously demanding the service prove its worth under new leadership.

For users, this is unambiguously positive. More content variety, better localization, and Apple's continued commitment to the platform. For Apple shareholders, the question remains whether throwing a wider net will catch enough subscribers to justify the investment.

The answer will come not from today's announcement, but from churn metrics six months from now. If users in India, Japan, Hong Kong, and Singapore find lasting value in Fitness+, this expansion will be remembered as the strategic pivot that saved the service. If not, it will be seen as Apple buying time before making harder decisions.

Either way, the clock is ticking. With Eddy Cue's services team now directly accountable for results, Fitness+ has moved from "nice to have" to "needs to perform." Today's expansion is Apple's bet that scale solves retention—a hypothesis that's about to be tested across 28 new markets.

Discussion